The Accounting Chamber conducted a financial audit of the Verkhovna Rada. This is the first parliamentary audit in the history of Ukrainian independence. We have analyzed the report based on the audit results and are ready to share the main conclusions.

The audit was conducted for the period 2013-2019. Experts found violations of the order of use of funds and/or inefficient use of funds in most areas. Nevertheless, the Verkhovna Rada Staff fulfilled its main goal – to ensure the Verkhovna Rada of Ukraine’s activities.

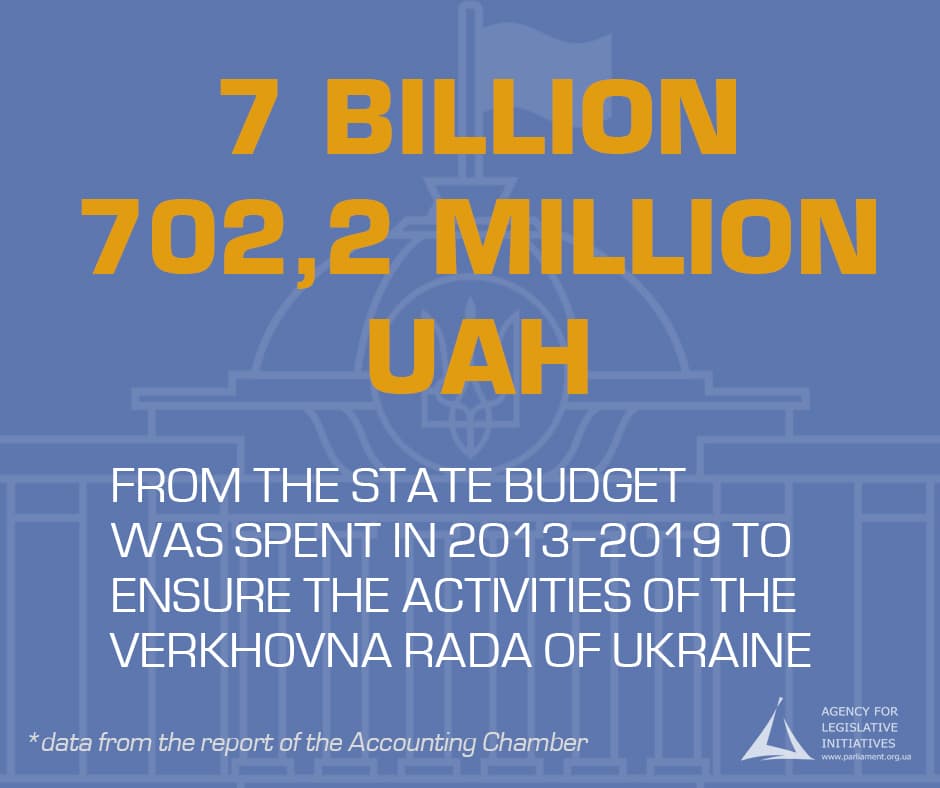

A total of UAH 7 billion, 702.2 million, was used in 2013-2019. The main item of expenditure of the Verkhovna Rada was wages and salaries: 70% of current spending (UAH 5 billion 426 million) was spent on it.

The audit also revealed significant legal gaps in the Verkhovna Rada activities, which resulted in violations of the procedure for the use of funds. The main legal gap is the Regulations’ approval on the Staff of the Verkhovna Rada (a document regulating the activities of the Office) by order of the Chairman of the Verkhovna Rada. However, Art. 7 of the Rules of Procedure of the Verkhovna Rada requires that this provision must be approved by a resolution of the Verkhovna Rada. As a result, the Office is not a legal entity and cannot independently carry out financial and logistical activities to ensure Verkhovna Rada’s work. Instead of the Office, such support is provided through its subdivision – the Office of the Verkhovna Rada, which is a legal entity.

Among other legal gaps, it can also be noted that a significant part of the VRU’s material base is not designed correctly. In particular, the procedure of state registration of real rights to immovable property was not carried out in respect of the following property:

- 198 of 326 buildings;

- 231 out of 330 engineering structures;

- 13 out of 49 land plots do not have title documents.

The Accounting Chamber negatively assessed the transparency and accountability of the Office. In 2014-2017, the Verkhovna Rada did not have approved estimates! This is a violation of Part 4 of Art. 7 of the Rules of Procedure of the Verkhovna Rada. When the estimates were approved (2013, 2018, 2019), the Verkhovna Rada still did not consider reports on their implementation. That is, MPs did not control the Office’s activities in the study period (2013-2019). The Internal Audit System of the Office also received a negative assessment from the Accounting Chamber.

The audit focused mainly on the financial side of the VRU but partially covered some aspects of the parliament’s units’ direct activities. This applies, in particular, to the Institute of Legislation. The Accounting Chamber pointed out that 78.9% of people who studied in postgraduate and doctoral studies in 2013-2019 were not MPs of Ukraine, representatives of the Office and local governments, although these categories of people should be directed to the methodological assistance of the Institute.

The recommendations provided by the Accounting Chamber partly reflect the recommendations of the Roadmap on Internal Reform provided by the European Parliament’s Needs Assessment Mission to the Verkhovna Rada.

For example:

- The 35th recommendation said to conduct an audit of the Verkhovna Rada – accordingly, it was finally fully implemented.

- The 36th recommendation of the European Parliament Mission is about the creation of a single set of internal rules that would regulate the work of the Office. The Regulation on the Staff of the Verkhovna Rada, which the Accounting Chamber recommends to approve by a resolution of the Verkhovna Rada, may become such a set of internal rules.

- The 37th recommendation of the European Parliament Mission is about the consolidation of all administrative units of the Verkhovna Rada into the structure of the Office. Proper approval of the Regulations on the Staff of the Verkhovna Rada and registration of the Office as a legal entity (as recommended by the Accounting Chamber) will allow for such consolidation.