Newsfeeds and TV news stories have repeatedly covered information about how the world’s first economies (USA, UK, Germany, Spain, etc.) are facing the economic crisis caused by the SARS-CoV-2 pandemic. However, when Ukrainians hear about 200 billion aid in Spain, half a trillion aid in Germany, or 3 trillion aid in the United States, these figures seem almost unrealistic. After all, the GDP of our country is about $130 billion. Spain alone has allocated funds to overcome the crisis in the amount of one and a half times the annual GDP of Ukraine. In fact, any amount allocated from developed economies to Ukraine will seem fantastic.

Therefore, we decided to take a look at how the economic consequences of the coronavirus crisis are confronted by our neighbors – those countries whose economic indicators and living conditions are more relevant for drawing analogies with Ukraine.

Types of responses to the economic crisis caused by SARS-CoV-2

This review analyzes the direct economic measures Ukraine and its neighbors have conducted to confront the economic crisis caused by the SARS-CoV-2 epidemic. These are direct payments, compensations, interest-free loans, or credit guarantees. They can be compared relatively easily.

In addition to these direct measures, all countries implemented tax, monetary and macro-financial measures. These can be exemptions from fines, postponement of certain taxes, cancellation of taxes or reduction of certain taxes, fees, contributions, a moratorium on inspections, postponement of loan payments, change of the discount rate, revision of criteria for granting loans, etc. Their comparison is not as obvious, and a detailed examination requires a significant immersion in the specifics of the tax and banking systems of each state, so these measures are out of the scope of this material.

The SARS-CoV-2 epidemic is associated with the introduction of quarantine, restrictions on the movement of citizens, as well as the work of companies and sometimes entire industries. As a result, the demand for certain goods and services is declining, and the companies that provide them are reducing the amount of money to pay wages. If a person does not get a salary, he will not have the funds to buy other goods and services. Therefore, the lack of funds will hit the demand even after the end of quarantine. It turns out a vicious circle that was triggered by the introduction of quarantine: reduced demand → lack of funds for the payment of wages → reduced demand.

Declining demand means that companies lack operating funds, so they cannot sustain themselves. Thus, the production and supply chains are interrupted.

Therefore, government measures to combat the economic crisis caused by the coronavirus include (or should include) ensuring the functionality of the economy, namely – guaranteeing the payment of wages and providing companies with funds to continue the operation of supply chains.

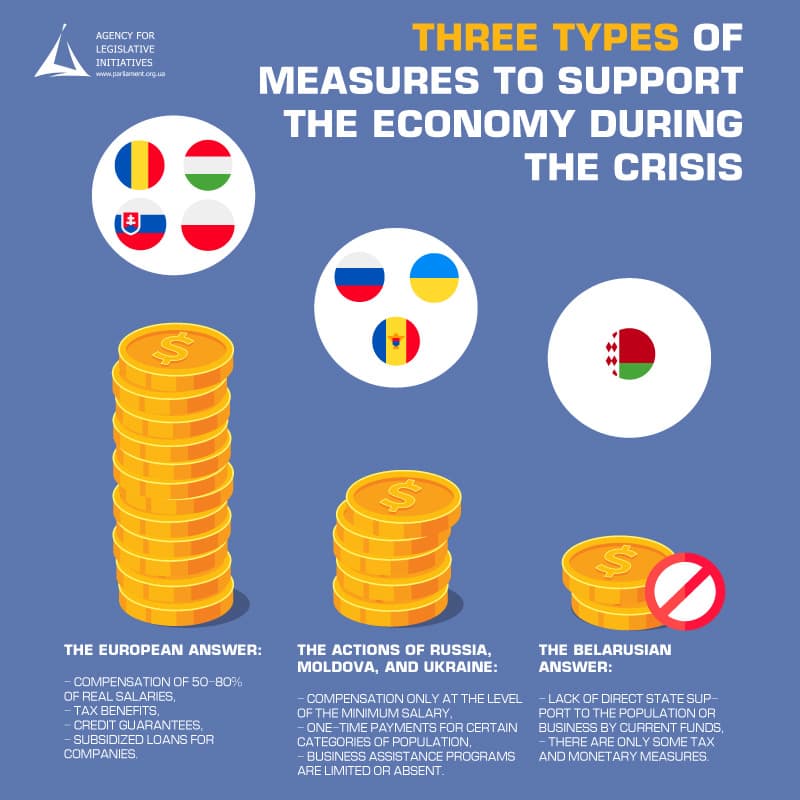

If we consider Ukraine and its neighbors, we can distinguish three types of measures to support the economy during the crisis.

The first type, or the European answer

Poland, Slovakia, Romania, and to some extent, Hungary are following this path. In these countries, the state compensates the employer 50-80% of the employee’s salary. Even if a person is temporarily out of work (for example, the company has suspended its activities due to quarantine and epidemic) or if one parent is forced to stay at home caring for a child (who does not go to school / kindergarten), he/she is still paid 50-80% of salary. Medium and small enterprises that continue to operate but have lost part of their income receive additional funds to pay salaries to employees. The amount of these funds depends on the percentage of lost income.

In addition, the European Commission has adopted a framework document to support the economies of EU member states. It is on this basis that Poland, Slovakia, Romania, and Hungary build their policies to help the economy. This document provides the following:

- Direct grants, capital investments, selective tax benefits of up to 800,000 euros per company to meet the urgent need for liquidity.

- State guarantees of loans for companies. They can cover up to 90% of credit risks, and loans up to 800,000 euros – 100% of credit risks.

- Subsidized loans for companies to cover immediate working capital. For loans up to 800,000 euros – loans at 0% interest rate.

- Support in the form of salary subsidies.

- Support in the form of deferred payment of taxes or social security contributions.

There are other measures, but these are the fundamental ones.

The second type of answer

Ukraine, Russia, and, to some extent, Moldova belong to the second type of response. They have slightly increased unemployment benefits and can compensate for the minimum wage. In addition, one-time payments are made to certain categories of the population (pensioners and children). Business assistance programs in the form of interest-free loans for the payment of wages and working capital – either limited or absent.

The third type of answer, or the Belarusian answer

Is about the lack of direct state support. There are no special unemployment benefits or special forms of lending. Belarus has introduced some tax and monetary measures, but there is no direct assistance to provide the population with money or business in working capital.

Now, in details about each country

The review was written using IMF materials and separate sources (laws, analytical articles), links to which can be found at the end of a detailed description of each country’s activities.

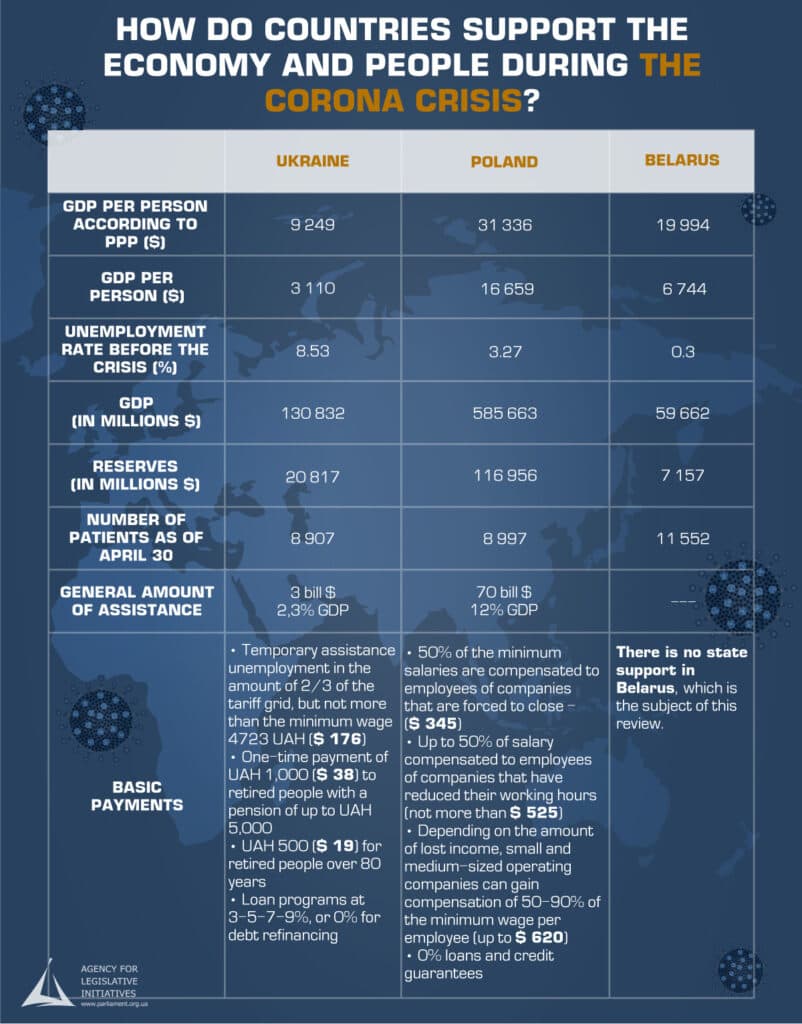

Ukraine

- Small and medium-sized businesses can, in accordance with the Act. 471 of the Law “On Employment”, to receive funds to pay their employees, partial unemployment benefits. This assistance is provided in the amount of 2/3 of the tariff grid according to the number of hours for which the activity of the enterprise has decreased, but not more than the amount of the minimum wage (UAH 4,723).

- Pensioners with a pension of less than UAH 5,000 received a one-time benefit of UAH 1,000.

- Pensioners over the age of 80 and some other categories of the population received a pension increase of UAH 500.

- Unemployment benefits increased by UAH 170-350.

- Private individuals or groups 1 and 2 of single taxpayers receive UAH 1,779 per month per child under the age of 6 and UAH 2,218 per month per child aged 6-10.

- Doctors involved in the fight against SARS-CoV-2 receive a supplement of additional 300% of salary, and social workers involved in the fight against SARS-CoV-2 must receive a supplement of 100% of salary.

- For small and medium-sized businesses there is a program 3-5-7-9. The state subsidizes interest rates on loans up to the level of 3, 5, 7, or 9% for the fulfillment of certain conditions (such as the continuation of activities, preservation of jobs, etc.).

- Loans at 0% interest rate are provided to refinance existing debts in Ukrainian banks. This means that if the employer already has loans, he/she can take a new loan at 0% rate to repay the old loan. Therefore, the state seems to postpone the repayment of the old loan. To do this, the employer must maintain at least 60% of the wage level for at least 80% of workers.

- The total amount of state support should not exceed 200,000 euros per 1 company.

- Also, in accordance with paragraph 5 of the Final and Transitional Provisions “Fundamentals of Ukrainian Legislation on Health Care”, the Cabinet of Ministers together with the NBU should develop and approve a national program of targeted loans to provide a salary fund with a grace period by the end of April. This is the program that is being implemented in the EU and is in a limited form, even in Russia. But so far, such a program has not been approved.

- The total amount of funds allocated to support the economy during the coronavirus can be estimated at UAH 82.4 billion, or $ 3 billion, or 2.3% of GDP. The expenditure part of the budget was increased by this amount in accordance with the amendments to the Law of Ukraine “On the State Budget of Ukraine for 2020” of April 13, 2020. At the same time, part of the budget was redistributed. Key figures include the $65 billion for the Anti-Epidemic Fund, $15 billion for the Ministry of Health, and $ 10 billion for pension increases.

- Thus, in Ukraine there are unemployment benefits at the level of 2/3 of the tariff grid, but not more than the minimum wage, there are one-time benefits; there is a program 3,5,7,9 and refinancing at 0% interest rate, but currently there are no programs to reimburse wages provided its payment by the employer and there is no program to ensure the liquidity of companies at 0% rate and credit guarantees, as in the EU.

- In addition, other measures have been introduced, such as the abolition of certain fines for violating tax laws, the abolition of the single social contribution for certain categories, the ability to deduct funds spent on treatment from SARS-CoV-2, when paying PIT, the abolition of penalties for overdue loans for the time of quarantine, temporary abolition of taxes on land and real estate, other measures of indirect support of the economy.

Poland

- The state compensates 50% employer minimum wage (1300 PLN $ 345) per 1 employee. This assistance is paid to companies that have been forced to suspend work for the duration of the quarantine. The employer in this case has to pay the salary of 50% of the base rate of the employee, but not less than the minimum wage.

- Employers who have reduced working hours by 20-50% receive subsidies from the state in the amount of 50% of the employee’s salary, but not more than 40% of the average salary in the country (PLN 2,200, $ 525).

- In addition, small and medium-sized enterprises whose income has fallen may receive subsidies in an amount that depends on the amount of lost income:

- If sales have fallen by 30%, you can get 50% of the minimum wage per employee.

- If sales fell by 50%, you can get 70% of the minimum wage per employee.

- If sales fell by 80%, you can get 90% of the minimum wage per employee.

- Allocated additional funds for medical equipment.

- Childcare payments

- A program for loans at 0% and credit guarantees.

- Budgetary measures are estimated at 93 billion zlotys or 4.2% of GDP.

- The loans and loan guarantees program are estimated at PLN 75 billion, or 3.3% of GDP.

- The business liquidity program is estimated at PLN 100 billion, or 4.5% of GDP.

- Overall program to support the economy is estimated at nearly 300 billion zlotys, or $ 70 billion, or 12% of GDP.

- In addition to direct support, companies with 10-49 employees receive compensation of 50% of insurance payments, companies with up to 9 employees receive compensation of 100%. In this part of taxes and contributions canceled or postponed payment of their term, there are other taxes and monetary measures.

Belarus

- Unlike other Ukrainian neighbors and Ukraine itself, Belarus has not implemented any direct economic support measures. President of Belarus does not consider the epidemic of SARS-CoV-2 significantly dangerous. Quarantine measures in Belarus are very limited (compared to other countries), moreover, on May 9 there was a parade.

- Tax benefits and deferred taxes were announced, but it is not clear how and when they will be implemented.

- Among the measures already taken are tax benefits and vacations. However, they were taken on April 24, after the deadline to pay taxes, so their influence is quite limited.

- Belarus has introduced some monetary measures (both fiscal and monetary measures are not the subject of this review, so details will not be discussed). Most of them are of a recommendatory nature. In general, even the monetary measures adopted in Belarus are significantly inferior to the monetary measures of other states.

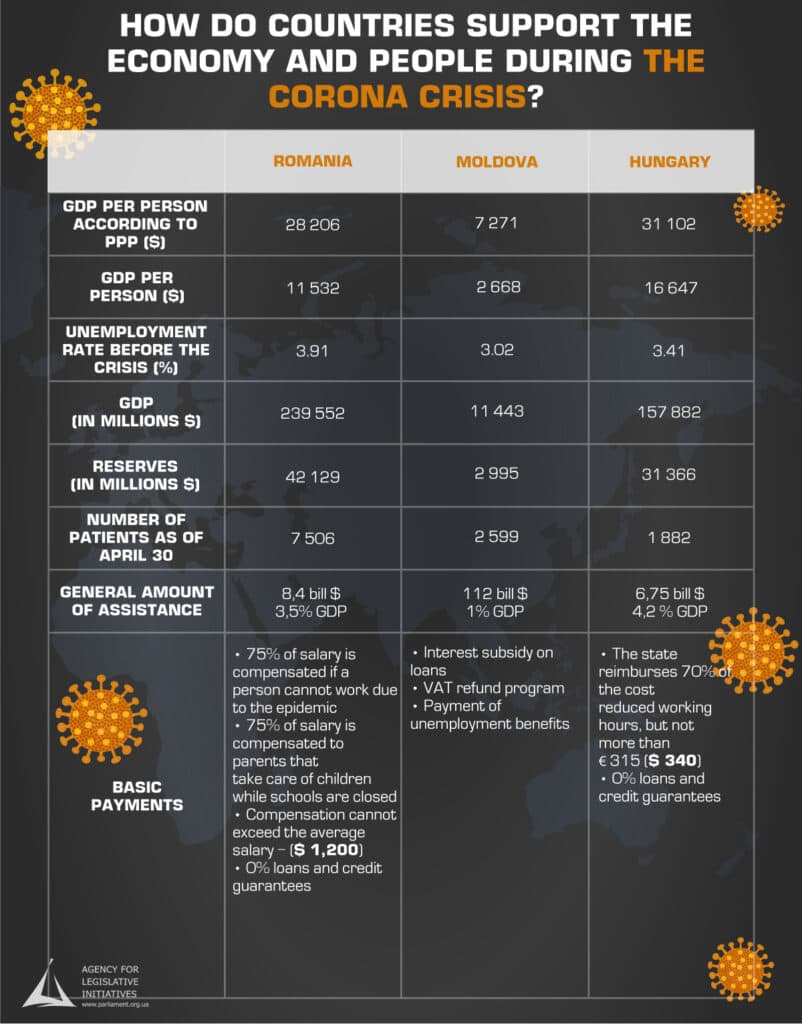

Romania

- 2% of GDP (about $ 4.8 billion) is planned to be spent on:

- Compensation of 75% of the salary of workers who are technically unemployed – that is, when the company cannot work due to quarantine and the SARS-CoV-2 epidemic.

- 75% pay compensation to parents who care for children while the schools are closed.

- Compensation cannot exceed the average salary – 5429 lei ($1200).

- Increased health funds.

- 1.5% of GDP (about $ 3.6 billion) is planned to be spent on a business support program: interest-free loans, coverage of up to 90% of credit risk, credit guarantees, etc.

- An expenditure totaling 35 billion lei, or $ 8.4 billion, or 3.5% of GDP.

- In addition to direct support, there are tax rebates on income tax, deferral of payment for utilities for three months, deferral of payment of property tax for three months, other tax and monetary measures.

Moldova

- With the outbreak of the SARS-CoV-2 epidemic in Moldova, a state of emergency was declared and a number of payments were made. However, the political opposition appealed the decision to allocate these funds to the Constitutional Court due to the fact that the law was not approved by parliament. Therefore, on April 9, the constitutional court declared the law invalid, and the approved payments also became invalid.

- Later, on April 23, the government was able to pass a law in parliament amending the state budget. The parliament approved loan agreements with the IMF and Russia. However, on May 7, the Constitutional Court declared the agreement with Russia unconstitutional. Measures taken under the “first anti-crisis package” were partially transferred to the second package, and new measures were added to them.

- The “first anti-crisis package” allocated 700 million lei, or $ 39 million. 2,775 lei ($ 150) was planned to be paid as unemployment benefits, including payments to citizens who returned from abroad. It was also planned to pay the difference in unemployment benefits if it did not reach 2775 lei. Minimum social benefits were increased by 200 lei ($ 11) and child benefits were increased by 400 lei ($ 22). Farmers were to receive 800 lei ($ 44) in subsidies.

- After the first anti-crisis package was declared invalid, it was planned to send 300 million lei to help entrepreneurs, 6 million lei to help health workers, 168 million lei to unemployment benefits, 200 million lei to social assistance and 10 million lei to create new jobs.

- On April 23, the second anti-crisis package was approved. Then the expenditure part of the budget increased by 2 billion lei ($ 112 million), or almost 1% of GDP. 1 billion lei was spent on VAT refunds in the form of the difference between the amount of VAT paid and the amount of taxes paid on wages. It was a business support move. Another 90 million lei was used to subsidize interest on loans and pay salaries. The rest went to health care and social benefits.

- Thus, given the weekly changes in the distribution of budget funds, it is difficult to determine any constant for comparison with other countries. Therefore, we can only conclude that anti-crisis measures in Moldova consist of subsidizing interest on loans, unemployment benefits, one-time social benefits, and VAT refunds.

- In addition, tax and monetary measures were introduced: postponement of tax payments, change in the discount rate, and other measures.

Hungary

- Employers who were forced to reduce working hours by 15-75% receive state compensation. This compensation covers 70% of the cost for these hours, but not more than 315 euros per month for a period of three months. This measure is somewhat out of line with the pan-European trend, as benefits are actually tied to the minimum wage, while in Romania, Slovakia, and Poland, benefits are tied to the employee’s normal (rather than minimum) wage and are limited to the national average.

- Doctors receive a bonus of 1360 euros.

- 1.5 trillion forints ($ 4.6 billion) has been allocated for a package of financial instruments to help businesses. These are three types of loans, two financial guarantee instruments, and four capital programs. All this includes interest-free loans and coverage of up to 90% of credit risk.

- HUF 450 billion ($ 1.4 billion) is allocated for investment with job creation.

- HUF 245 billion ($ 750 million) has been reallocated to the medical field.

- In total, it is planned to spend 2.2 trillion forints, or $ 6.75 billion, or 4.2% of GDP.

- In addition to direct support, Hungary also has tax rebates, exemptions from certain taxes, and other tax and monetary measures.

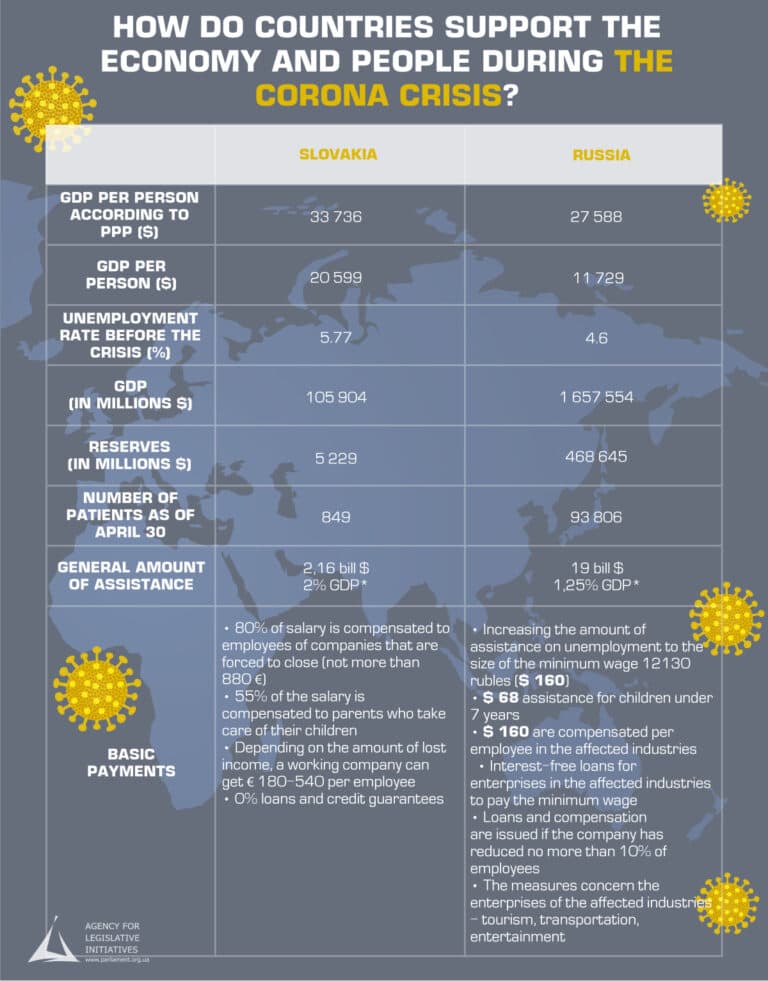

Slovakia

- Workers, of those companies that were forced to close temporarily due to quarantine and the epidemic, are paid 80% of their salaries. They are compensated by the state. These payments may not exceed 880 euros per worker.

- Under certain conditions, parents can take childcare leave. Then they are paid 55% of the salary.

- Depending on the amount of lost income, companies receive financial assistance:

- if the company has lost 20% of its income, the state pays 180 euros in benefits per employee;

- if the company has lost 40% of its income, the state pays 300 euros in benefits per employee;

- if the company has lost 60% of its income, the state pays 420 euros in benefits per employee;

- if the company has lost 80% of its income, the state pays 540 euros in benefits per employee;

- Payments are limited to 200,000 euros per company.

- A total of € 1 billion a month is allocated to help companies.

- € 500 million per month is allocated to provide loan guarantees to companies.

- EUR 150 million is allocated for financial instruments to provide liquidity.

- The total amount of financial assistance is about 2 billion euros per month or 2% of GDP. These measures were introduced in late March-early April. That is, the total amount spent on supporting the Slovak economy will have to be calculated at the time of termination of quarantine, and it will be more than the funds spent in one month in April.

- In addition to direct support, employers have an option of deferring social benefits (if they have lost more than 40% of income). A moratorium on the payment of rent until June 30 has also been introduced, tax rebates are in effect, the deadline for payment of part of the taxes has been postponed, and other taxes and monetary measures are in force.

Russia

- Unemployment benefits rose by 4,000 rubles – to the minimum wage of 12,130 rubles (about $ 160).

- 5,000 rubles ($ 68) paid on childcare allowance for the children under 3 years old.

- Families whose average income per family member does not exceed the subsistence level can receive child support for children aged 3-7 in the amount of 50% of the subsistence level for the region in which the family lives. The average income in Russia is 5,500 rubles ($ 75).

- Physicians working with SARS-CoV-2 patients receive additional social benefits:

- Doctors will receive 80,000 rubles ($ 1,088) a month;

- Nurses will receive 50 thousand rubles ($ 680) per month;

- Junior medical staff will receive 25,000 rubles ($ 340) per month.

- Companies in the areas most affected by quarantine and the epidemic can receive the following assistance:

- Payroll loans provided that the company has reduced its staff by no more than 10%. The loan is issued for up to 12 months, of which the first 6 months – interest-free.

- Assistance in the amount of 12,130 rubles (the minimum wage) per employee, provided that the company has reduced its staff by no more than 10%.

- These measures apply only to companies in those industries that have suffered the most from quarantine and the epidemic. Namely – the field of transportation, tourism, physical culture and health activities, culture, and entertainment.

- Subsidizing interest rates on loans to developers and up to half the amount of the contract rate for loans to small and medium enterprises under certain conditions.

- In March, 300 billion rubles were allocated to support the economy, later another 200 billion rubles were added to help the regions. Experts estimate the total amount of allocated (reserved) aid at almost 1.5 trillion rubles, or $ 19 billion, or 1.25% of GDP. Expert assessment of the whole set of measures, including indirect measures, is estimated at 2-2.8% of GDP.

- In addition to direct support, insurance payments for small and medium-sized businesses have decreased from 30 to 15%, social contributions are reduced or transferred, part of taxes and contributions is deferred, and other taxes and monetary measures are in place.